wake county nc sales tax breakdown

Most people in the neighborhood own their home with 68 of households being occupied by owners. North Carolina state sales tax.

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Plus 20 Recycling fee.

. 3 rows Wake County NC Sales Tax Rate. These revenues include a one-half cent sales tax Article 43 sales tax that can be levied in each county if approved by public referendum. Sales Tax Breakdown.

Within one year of surrendering the license plates the owner must present the following to the county tax office. 6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina. Hedingham Village is a neighborhood in Raleigh.

Any municipal vehicle tax assessed in accordance with NC General Statute 20-97 is not subject to proration or refund. Wake County Sales Tax Rate 2019 Coupons Promo Codes 11-2021. Wake County sales tax.

The North Carolina state sales tax rate is currently. Sales Tax Breakdown. The overall risk of crime in Hedingham Village is 65 lower than the.

The price of all motor fuel sold in North Carolina also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to support the Federal Highway Administration. It occupies approximately 048 square miles. Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Manufactured and Modular Homes.

Historical County Sales and Use Tax Rates. The current total local sales tax rate in Wake County. Human Services Call Center 919-212-7000.

Overall expenses in Hedingham Village are 22 lower than the National Average. For tax rates in other cities see. 3 rows Sales Tax Breakdown.

Proof of plate surrender to NCDMV DMV Form FS20 Copy of the Bill of Sale or the new states registration. The 2018 United States Supreme Court decision in South Dakota v. Wake County Public Schools 919-431-7400.

County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted By 5-Digit Zip. Federal excise tax rates on various motor fuel products are as follows. Wake County Public Libraries 919-250-1200.

6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina. Wake County Managers Office 919-856-6180. County rate 60 Raleigh rate 3730 Combined Rate 9730 Recycling Fee 20.

To review the rules in North Carolina visit our state-by-state guide. Wake County collects on average 081 of a propertys assessed fair market value as property tax. Wake County Courts 919-792-4000.

The 725 sales tax rate in Wake Forest consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax. That makes the countys average effective property tax rate 088. There is no applicable city tax.

Has impacted many state nexus laws and sales tax collection requirements. Property value divided by 100. The property is located in the City of Raleigh but not a Fire or Special District.

The Wake County sales tax rate is. Wake County NC Sales Tax Rate Wake County NC Sales Tax Rate The current total local sales tax rate in Wake County NC is 7250. The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund.

Aircraft and Qualified Jet Engines. 2000 x 97302 194600. In August 2009 the NC General Assembly ratified the Congestion Relief and Intermodal Transport Fund Act allowing Orange Durham and Wake Counties to generate new revenue for public transportation.

This is the total of state and county sales tax rates. 17 rows The total sales tax rate in any given location can be broken down into state county city. You can print a 725 sales tax table here.

Historical Total General.

Wake County North Carolina Property Tax Rates 2020 Tax Year

Wake County North Carolina Property Tax Rates 2020 Tax Year

Organizational Chart Town Of Wake Forest Nc

North Carolina Sales Tax Small Business Guide Truic

Historic Districts Town Of Wake Forest Nc

Wake Forest Map Town Of Wake Forest Nc

2021 Best Zip Codes To Buy A House In Wake County Nc Niche

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Amazon Com Wake County North Carolina Zip Codes 48 X 36 Paper Wall Map Office Products

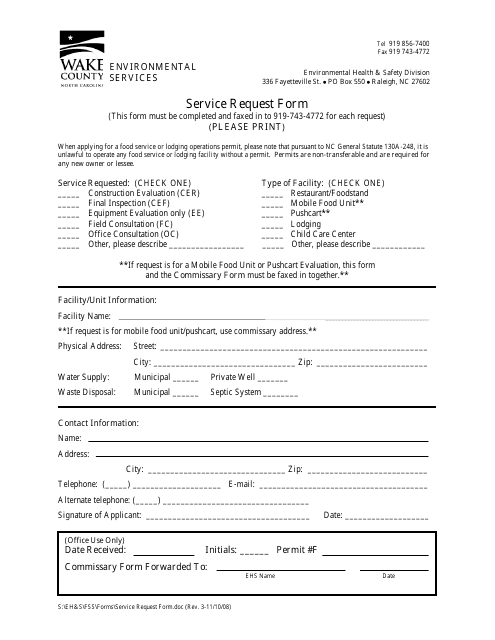

Wake County North Carolina Service Request Form Download Printable Pdf Templateroller

New Businesses Coming To Wake Forest Town Of Wake Forest Nc

Wake County Nc Property Tax Calculator Smartasset

Town Tree Town Of Wake Forest Nc

North Carolina Sales Tax Rates By City County 2022

Taxes Wake County Economic Development

Watershed Education Town Of Wake Forest Nc

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

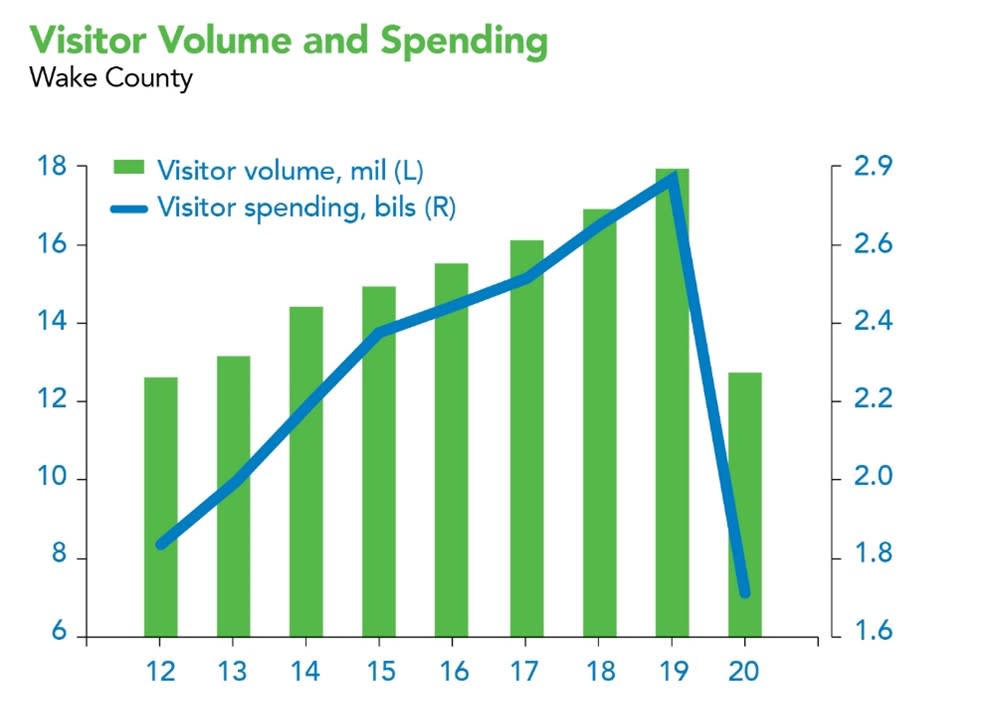

2020 Wake County Visitation Figures Released

Amazon Com Wake County North Carolina Zip Codes 48 X 36 Paper Wall Map Office Products