hotel tax calculator illinois

It costs 134 to. Illinois Income Tax Calculator 2021.

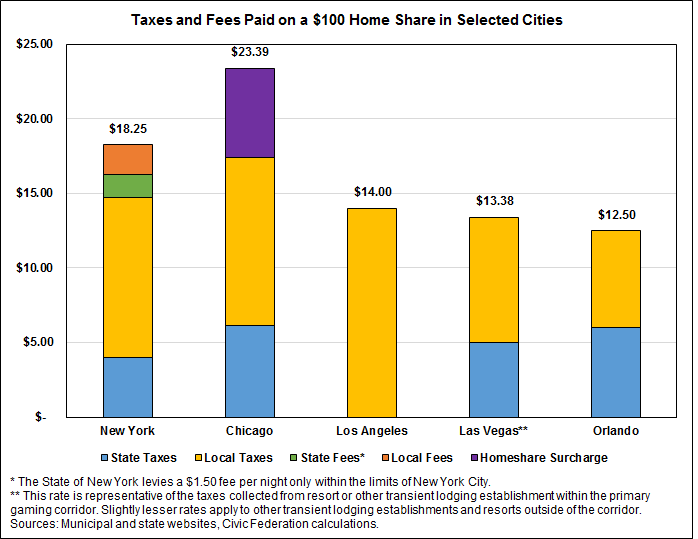

How Do Chicago S Hotel And Home Share Taxes Compare To Other Cities The Civic Federation

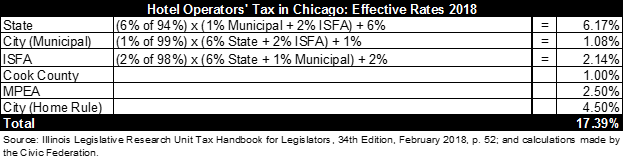

2 of 98 tax on gross receipts in.

. Use our gas price calculator below to see. But it is worse in Illinois where drivers pay the nations second-highest gas taxes. Also not city or county levies a local income tax.

7 state sales tax plus 1 state hotel tax 8 if renting a whole house. The tax is imposed on the occupation of renting leasing or letting rooms to persons for living quarters for periods of less than 30 consecutive days. The hotel operators occupation tax in Illinois is as follows.

After a few seconds you will be provided with a full breakdown of the. Avalara automates lodging sales and use tax compliance for your hospitality business. The new form mirrors the 7520 tax return but the Tax and the Surcharge should be paid and reported separately beginning with the December 2018 payment due 11519.

Illinois has a 625 statewide sales tax rate but also. Only In Your State. 7 state sales tax plus 6 state hotel tax 13 if renting a hotel or room.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. To use our Illinois Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. State hotel tax rate.

The following local taxes which the department collects may be imposed. You can calculate the rate with the multiply answer by 100. Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill.

Your average tax rate is 1198 and your marginal tax rate is. National gas prices are hitting all-time record highs. 6 of 94 of gross receipts.

Illinois Sports Facilities Authority hotel tax. So if the room costs 169 before. Convention hotels located within a.

If you make 70000 a year living in the region of Illinois USA you will be taxed 11737. Everyones income in Illinois is taxes at the same rate due to the states flat income tax system of 495. Ad Finding hotel tax by state then manually filing is time consuming.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Ad Finding hotel tax by state then manually filing is time consuming. 54 rows 3 State levied lodging tax varies.

Except as noted on their respective pages the preprinted rate on the return will include any locally imposed taxes. If you are purchasing a hotel room before taxes divide by how much the tax is in percentage form. Helpful Paycheck Calculator Info.

Avalara automates lodging sales and use tax compliance for your hospitality business.

Property Tax City Of Decatur Il

Ohio Sales Tax Small Business Guide Truic

Hotel Operators Occupation Tax Excise Utilities Taxes

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Property Tax City Of Decatur Il

Property Tax Dekalb Tax Commissioner

States With Highest And Lowest Sales Tax Rates

How Do Chicago S Hotel And Home Share Taxes Compare To Other Cities The Civic Federation

Accuratetax Com Sales Tax Automation Solutions For E Commerce Businesses E Commerce Business Tax Software Solutions

Property Taxes Other Tax Information Yorkville Il Official Website

Want To Learn How To Organize Your Budget But Not Sure Where To Start I Ll Share 60 Simple Budget Categories To Hel Budget Categories Budgeting Simple Budget

What Are Payroll Taxes And Who Pays Them Tax Foundation

Setting Up Tax Rates And Adjusting Tax Options

The Independent Contractor Tax Rate Breaking It Down Benzinga

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)