wisconsin private party car sales tax

Youll also need registration documents which include. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

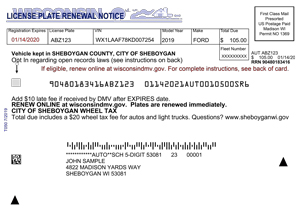

Wisconsin Dmv Official Government Site License Plate Renewal Options

Im not trying to avoid paying sales tax Im just trying to make sense of how WI can collect sales tax on a sale that was in another state.

. A Wisconsin retailer is required to collect the Wisconsin 5 state sales tax if the nonresident takes possession of the camper in Wisconsin. Any taxes paid are submitted to DOR. You may be penalized for fraudulent entries.

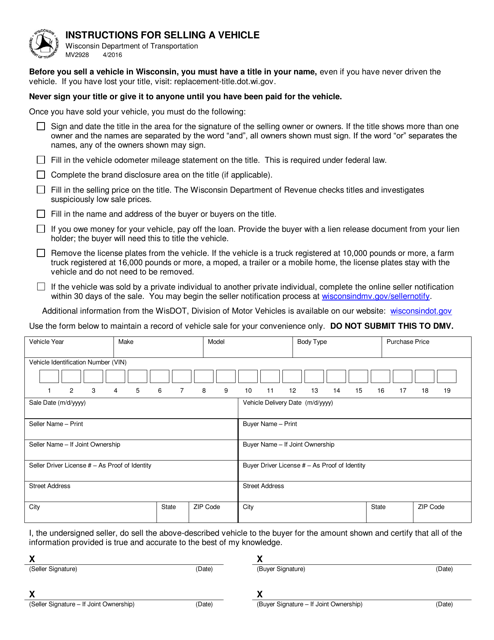

When you sell the vehicle fill out all of the information requested on the title eg odometer statement brand disclosure etc and sign the title as the seller and have the buyer sign as well. The national average state and local sales tax. An individual is not required to collect the.

Get a dealer license to sell more than five vehicles a year. Are drop shipments subject to sales tax in Wisconsin. I purchased a car in Minnesota from a private party and live in Wisconsin Im aware when I register the vehicle and transfer title at the WI DMV Im required to pay Wisconsin sales tax.

This document can be viewed and downloaded using the free Adobe Reader. This applies to purchases from both dealerships and private parties. Car Sales Tax on Private Sales in Wisconsin.

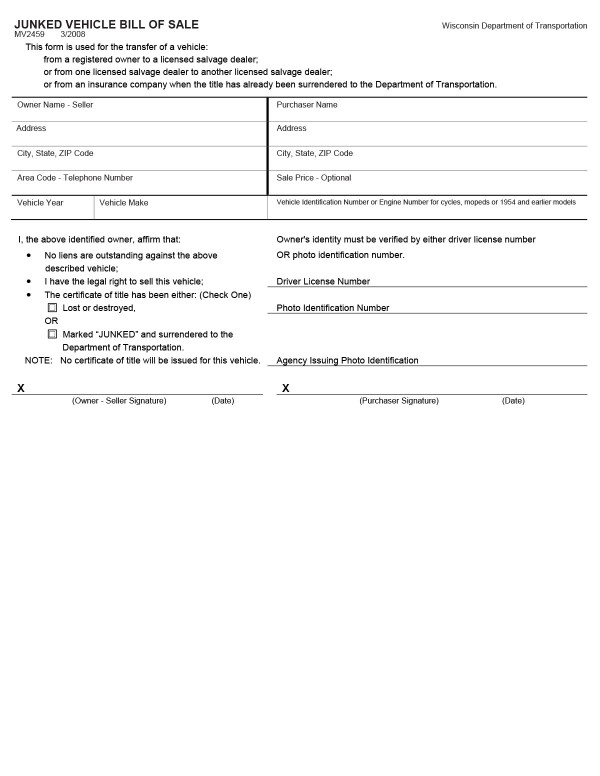

Selling a vehicle - points to remember. That amount is 1000. The Wisconsin Division of Motor Vehicles offers a downloadable form Instructions for Selling a Vehicle Form MV2928 that outlines the steps when making a private party purchase.

The total tax rate also depends on your county and local taxes which can be as high as 675. Call DOR at 608 266-2776 with any sales tax exemption questions. In Wisconsin drop shipments are generally subject to state sales taxes.

Depending on where you live when you buy a used car from a private party you most likely will be responsible for sales tax. Staying within budget when youre car shopping doesnt have to be difficult if you know what. However if a vehicle purchased in another state the District of Columbia or the Commonwealth of Puerto Rico is subject to sales tax in that jurisdiction a credit against Wisconsin sales or use tax due is allowed for sales tax paid to that jurisdiction up to the amount of Wisconsin tax due sec.

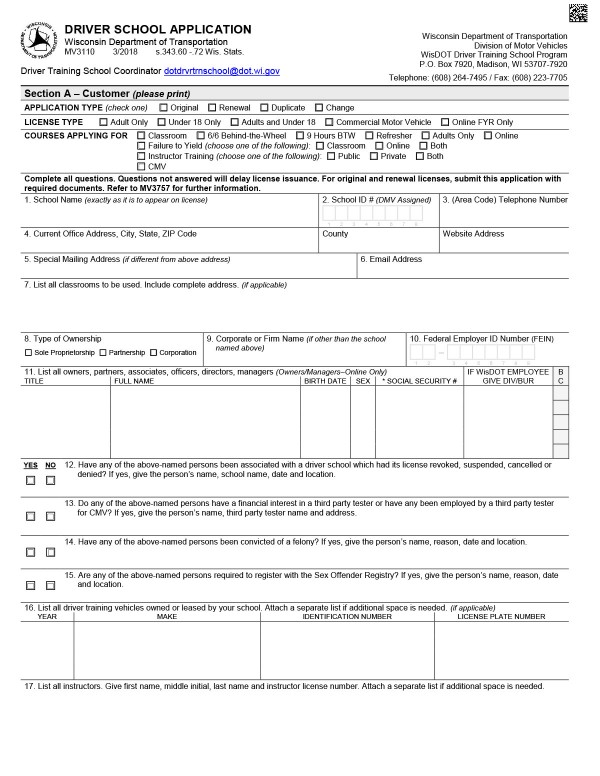

If you have questions about how to proceed you can call the department at 608 266-1425. At the time the ATV is registered in Wisconsin Nonresident A is required to pay the applicable Wisconsin state and county use tax due 5000 x 55 275 on his purchase of the ATV. Effective October 1 2009 all retailers that are registered to collect and remit Wisconsin sales and use taxes must also collect and remit the applicable state county andor stadium sales and use tax on its sales of the following items.

If you sell more than five or if you buy even one vehicle for the purpose of reselling it you must have a de aler license. A completed TitleLicense Plate Application Form MV1. In Wisconsin the state sales tax rate of 5 applies to all car sales.

But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit. A thorough bill of sale will include the buyers name and. Sales by a Private Party.

Lease or lienholder paperwork if applicable. Drop shipping refers to the common business practice in which a vendor often in a different state makes a sale of a product which is shipped to the end-user by a third party supplier hired by the initial vendor. Contact the DMV Dealer Agent Section at 608 266-1425 or.

Recreational vehicles as defined in sec. Sales taxes are typically payable anytime a cars ownership changes. Box 7909 Madison WI 53707-7909.

In some places a use tax applies. The Wisconsin Department of Revenue DOR reviews all tax exemptions. As an example if you purchase a truck from a private party for 20000 then you will pay 5 of that amount to the Wisconsin DMV.

16450 for an original title or title transfer. You can also apply by mail with form MV2119. A sales tax is required on all private vehicle sales in Wisconsin.

The 25 trail fee that Nonresident was required to pay to his home state may not be used to reduce the 275 Wisconsin use tax due on Nonresidents purchase of. Odometer reading if applicable. This includes a bill of sale.

WI Drivers license or ID card. Proof of WI car insurance. You may have to hire an attorney if the department cannot resolve the issue to your satisfaction.

Used cars display the Wisconsin buyers guide which gives the following information. Wisconsin law says you can sell up to five vehicles titled in your name in 12 months. WisDOT collects sales tax due on a vehicle purchase on behalf of DOR.

A vehicle with a collapsible or folding structure designed for human habitation and towed upon a highway by a motor vehicle. Standard fees charged by the state when purchasing a new vehicle in Wisconsin are. How a vehicle was used private use business use lease use rental etc Price.

Dealer Agent Section PO. The Wisconsin Certificate of Title is an important document that indicates ownership of the vehicle. Em ail AgentPartnershipUnitdotwigov Phone 608 266-3566 Fax 608 266-9552.

For both the online and mail-in options. Car title transfer private party car buying Michigan 1 replies AZ resident buying private party auto in IL Illinois 1 replies Buying car from private party. Wisconsin residents must pay a 5 percent sales tax on car purchases plus county taxes of up to 05 percent Some counties also charge a stadium tax of 01 percent notes the Wisconsin Department of RevenueFor example the state and local sales tax on vehicles registered in Bayfield County is 55 percent.

If the vehicles title has been lost stolen or badly damaged you can apply for a replacementduplicate Wisconsin title online and receive your title in the mail within 7-10 business days of the online application being completed. Title brands permanent brands that are on the title or will be on the next title Make year model identification number engine size and transmission type. Car has out of state plates Illinois 6 replies TN resident buying car in NC frm private seller -.

Payment for the fees due including. Note that while tax title and license fees can differ based on the type of vehicle being purchased weve compiled the ones that can be expected when purchasing and owning a. The average Wisconsin car sales tax including state and county rates is 5481.

Wisconsin Department Of Transportation Rolls Out New Law On Selling A Car Private

Car Sales Tax In Wisconsin Getjerry Com

Car Tax By State Usa Manual Car Sales Tax Calculator

How Much Are Tax Title And License Fees In Wisconsin

All About Bills Of Sale In Wisconsin Forms Facts And More

Wisconsin Car Registration Everything You Need To Know

Free Wisconsin Bill Of Sale Forms Pdf

Free Wisconsin Motor Vehicle Bill Of Sale Pdf Eforms

How Much Are Tax Title And License Fees In Wisconsin

All About Bills Of Sale In Wisconsin Forms Facts And More

Car Sales Tax In Wisconsin Getjerry Com

Wisconsin Car Registration Everything You Need To Know

Free Wisconsin Bill Of Sale Form Pdf Word Legaltemplates

Car Sales Tax In Wisconsin Getjerry Com

Form Mv2928 Download Printable Pdf Or Fill Online Instructions For Selling A Vehicle Wisconsin Templateroller

Free Wisconsin Motor Vehicle Bill Of Sale Pdf Eforms

Driving Without Insurance In Wisconsin Bankrate